Given the great deal of activity related to mergers, acquisitions and IPOs in 3D printing, we’ve started brainstorming about what other IPOs we’d like to see in the industry.

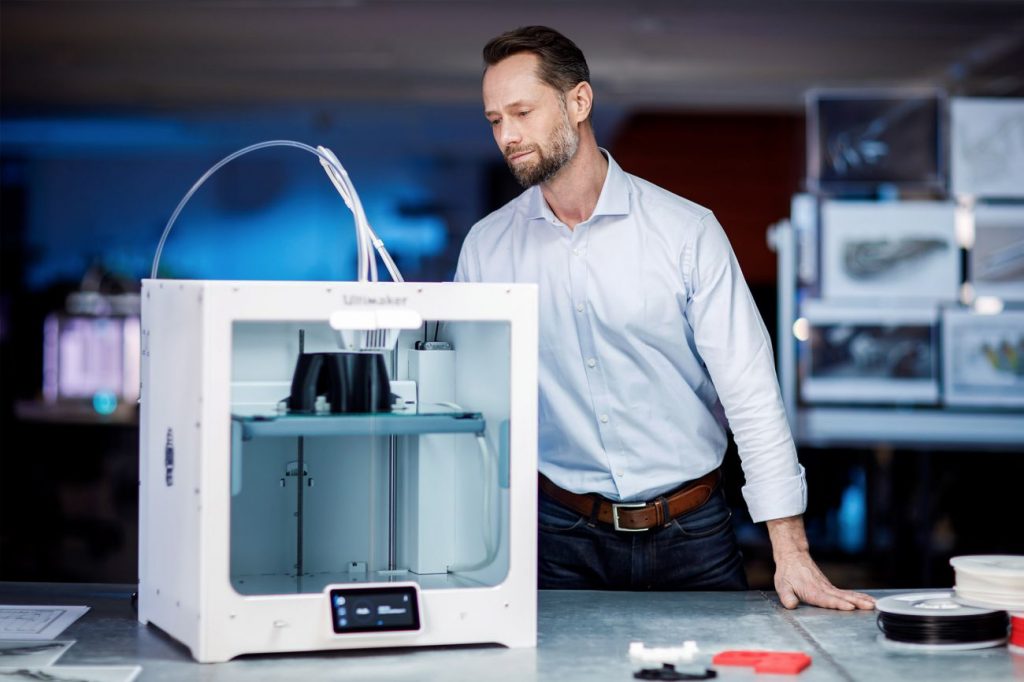

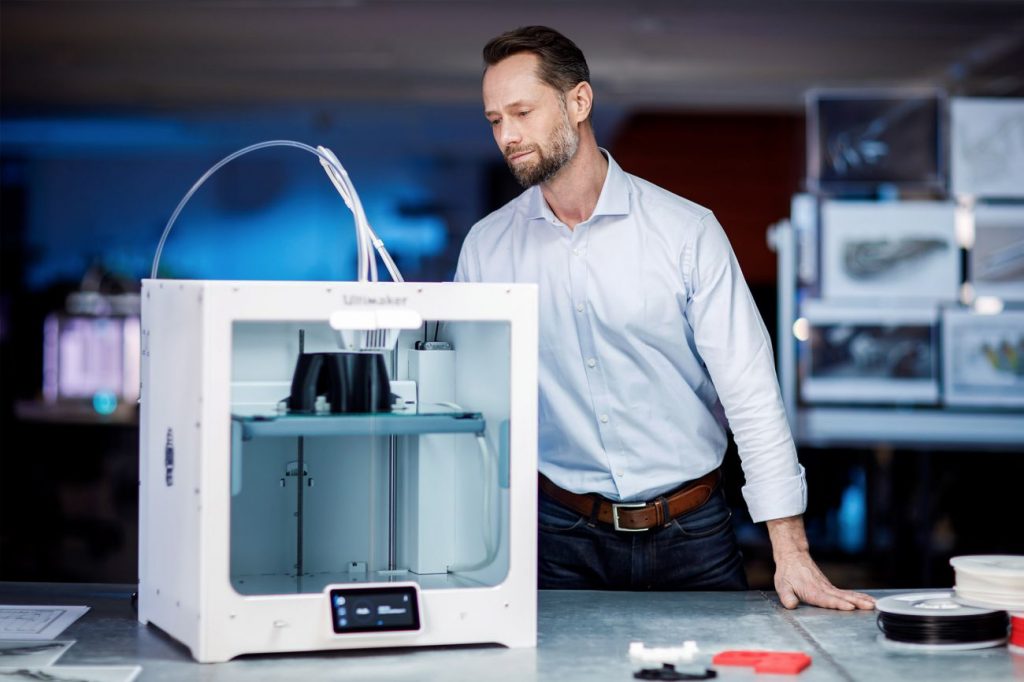

Ultimaker

Dutch desktop material extrusion firm Ultimaker pioneered 3D printer kits, open-source desktop 3D printers, and then went on to trail blaze 3D printers for business. The company is now developing an ecosystem of its own software, software by external parties, and materials partners. Its Cura product is strong, as is its Enterprise software offering. Meanwhile, it sells its wares via a global network of resellers. The 3D printers are pricey, but good and they work well for a long period of time, as well.

The focus on its own ecosystem has made the company much more insular than before and less likely to conduct the same experiments that laid the foundation for its explosive growth. But, it is assembling a long-term structure and team to go with it that should let them scale up and add one zero to their current revenues at least.

The company is trailed by the much smaller BCN3D, but leads the “in-office 3D printer” segment by a long stretch. By focusing on the enterprise, it has directed its energies on a segment where reputation counts. Its revenue is well above the entry-level for SPACs and it could easily do an IPO on a small scale. Current investors are conservative, however, and are in it for the long haul. But, now that the money is good, will the stock market perhaps tempt them? Growth should be excellent, as should be margins and teams. Management is competent and fleshed out. If it went public, Ultimaker would be expected to do well, but will it take the leap?

Prusa Research

The designs of Prusa Research have been copied by hundreds of firms. Indeed their printer designs are by far the most popular globally. Meanwhile, the company is very profitable and owned by the original partners. No debt, no silly VCs—just partners in it to grow. Prusa’s team is still perhaps a bit too Pirate Party for the stock exchange. I swear that there is this one guy probably named “Blas”, who is like the Jesus Nut holding the whole thing together. But, they have a considerable reputation, industry-leading quality, and quality assurance.

Prusa’s printers are incredibly good and good value, as well. They are also a huge player in filament and have a credible and growing stereolithography offering. The company is now developing all of its own software, as well. On the whole, I’m not sure it makes sense for the investors and the team, but it would be valuable for them to diversify. Perhaps a long-term “hold” type investor would make a lot more sense for the rambunctious open-source crowd.

However, the two reasons I do love the idea of a Prusa IPO would be to see what they’d do with the money, and to prove to the world that an open-source hardware business with integrity and a good product can “make it” financially, as well.

Fit Additive Manufacturing Group

With Shapeways going public via SPAC, Xometry preparing for an IPO, and Protolabs on the prowl, the U.S. seems to be in the driving seat for the coming consolidation in 3D printing services. With a very late start, the Americans are now catching up, and indeed buying two Dutch firms, and eclipsing the Europeans. Is it really going to be GKN and Materialise against the Americans? Or could a consolidation of German 3D printing services do something about this? FIT Additive Manufacturing Group has been run with vision and aplomb by Charlie Fruth for many years.

The visionary firm was the first to commercialize many different technologies and pioneered applications in end-use parts, such as orthopedics. It has diversified and has deep manufacturing knowledge. Previously, its software side was sold off to Autodesk as Netfabb. Could FIT merge with FKM and become a German leader in 3D printing parts? I’m sure they’ll all get along fantastically? Europe is filled with service bureaus that are very strong locally, but have no international reach. Consolidating these firms in a roll-up would be very valuable, especially with real manufacturing of end-use parts in metal. There is no real financial impetus, but such a play could make sense.

Carbon

Launched with much fanfare, Carbon’s take on vat polymerization was news the world over. The company then pioneered a, very profitable, leasing model for 3D printing. Pioneering partnerships with adidas and others, as well as material developments ,were the result of the company’s aim to push vat polymerization towards more end-use parts. The speed is there, but how much inertia and growth is there?

I’m still skeptical of thermoset materials as an end-use material for consumer applications. But, the company is aggressive, smart, and ambitious. Can it take its machines into many more production halls and applications? With Origin and RPS selling to Stratasys, Carbon may need to re-up to make a final push for world domination in vat polymerization.

If you're in need of 3D interior and exterior design services in the USA, our platform offers a comprehensive solution to bring your architectural projects to life. Through our service, you can request detailed 3D renderings that showcase both the interior and exterior of your property. Whether you're designing a home, office, or commercial space, our experts deliver photorealistic visualizations that highlight every element, from furniture arrangements to building facades, ensuring that your vision is accurately represented.

Through our website, you can easily access 3D interior and exterior design services tailored to your specific needs. With our help, you'll be able to create stunning visual representations of your designs, allowing you to present them to clients, investors, or stakeholders in a professional and engaging manner. Our team focuses on bringing out the best in your designs, ensuring that both the interior spaces and exterior elements are rendered with the highest level of detail and realism.